Biden Income Tax Policy, Election 2020 Comparing The Biden And Trump Tax Plans Cpa Practice Advisor

Biden income tax policy Indeed lately is being hunted by consumers around us, perhaps one of you. Individuals are now accustomed to using the net in gadgets to view image and video information for inspiration, and according to the name of the article I will discuss about Biden Income Tax Policy.

- Joe Biden Tax Plan What You Need To Know Cnnpolitics

- Trump S Taxes Show Deep Flaws In A System Rigged For The Rich

- A Tale Of Two Tax Policies Trump Rewards Wealth Biden Rewards Work Joe Biden For President Official Campaign Website

- Biden Tax Plan Estate Trust Planning Election 2020 New Guide

- What Bloomberg S Tax Bill Would Be Under Bernie Sanders Joe Biden Business Insider

- Voters Overwhelmingly Prefer The Warren And Sanders Tax Plans

Find, Read, And Discover Biden Income Tax Policy, Such Us:

- The 2020 Election Tax Comparison Trump V Biden Wes Moss

- These Households Can Expect A Tax Increase Under Biden S Tax Plan

- Election 2020 Comparing The Biden And Trump Tax Plans Cpa Practice Advisor

- Trump S Taxes Show Deep Flaws In A System Rigged For The Rich

- What Would Biden S Tax Policies Look Like Brink News And Insights On Global Risk

If you re searching for Are Kamala Harriss Parents Alive you've arrived at the right location. We ve got 100 graphics about are kamala harriss parents alive adding images, photos, pictures, wallpapers, and more. In such page, we additionally have variety of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

Understanding Joe Biden S 2020 Tax Plan Committee For A Responsible Federal Budget Are Kamala Harriss Parents Alive

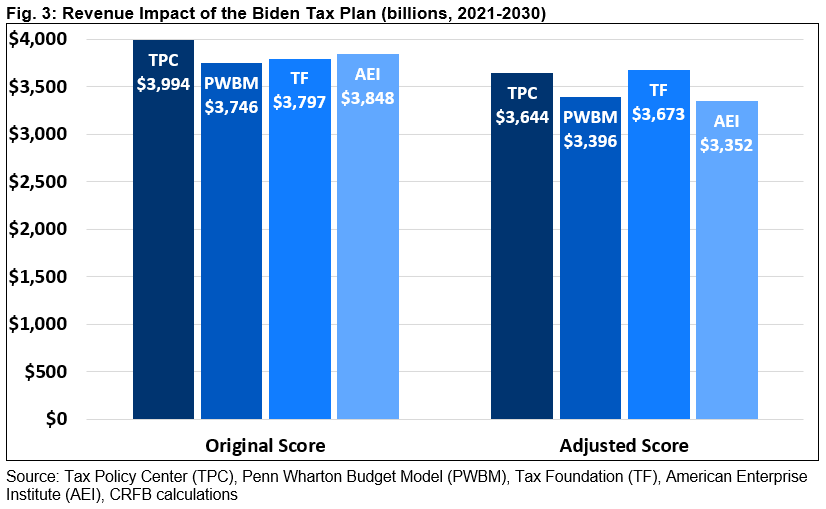

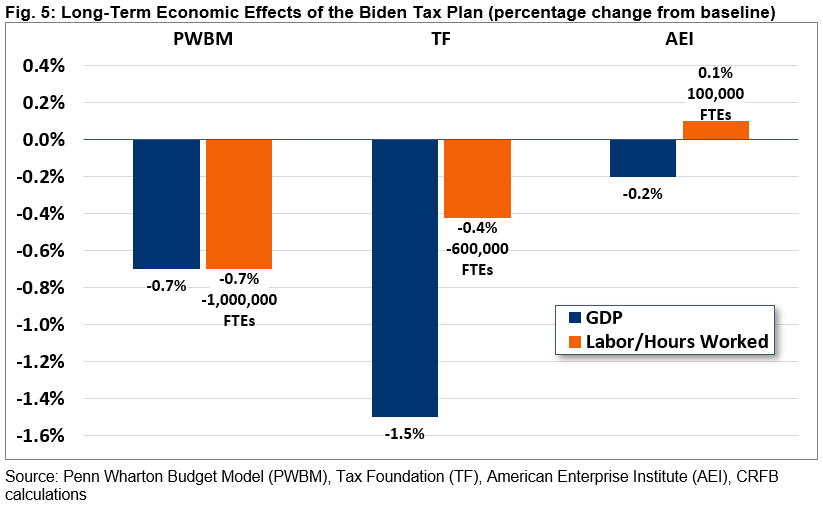

Bidens tax plan is estimated to raise about 333 trillion over the next decade on a conventional basis and 278 trillion after accounting for the reduction in the size of the us.

Are kamala harriss parents alive. The plan also limits deductions. For individuals bidens plan would increase income taxes and impose an additional 124 social security payroll tax on those earning at least 400000 per year. Biden would raise the top rate to 396 for.

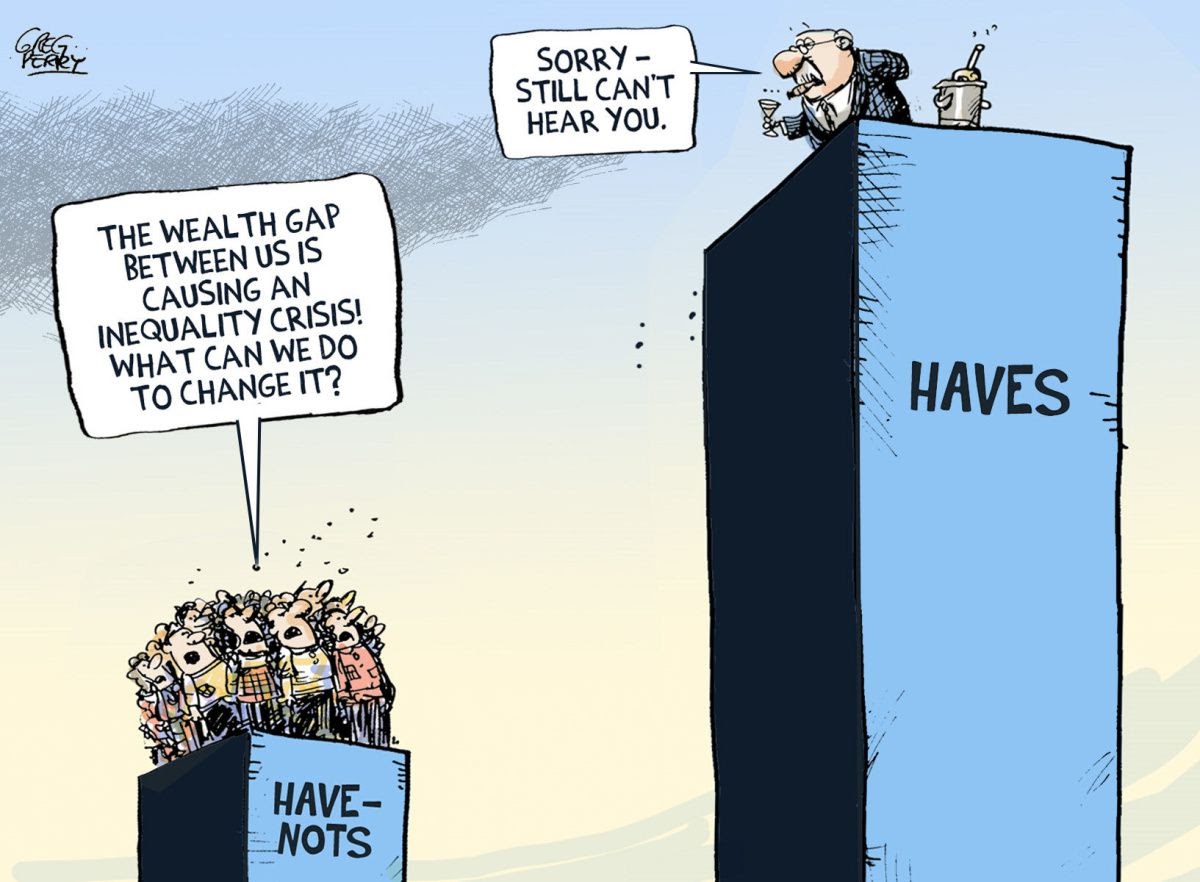

Based on information released by the biden campaign and conversations with its staff the tax policy center found that high income taxpayers would face increased income and payroll taxes. The table below shows what the effective tax rate would be for americans at different income levels relative to what they are currently paying if bidens tax plan took effect. For taxpayers in the lowest.

Under the biden plan the payroll tax would also apply to income over 400000 creating a donut hole in the policy. Income from 137700 to 400000 wouldnt be subject to the levy. Biden would repeal changes made to individual income tax rates for the wealthy individuals with incomes over 400000 under the 2017 tax cuts and jobs act which means the top rate would revert.

A key element of the biden policy is the use of tax credits often refundable rather than tax deductions to counter the greater savings that deductions provide to higher income taxpayers. While taxpayers in the bottom four quintiles would see an increase in after tax incomes in 2021 primarily due to the temporary ctc expansion by 2030 the plan would lead to lower after tax income for. The former vice president has an ambitious tax policy at least on paper.

Under bidens plan revenue generated from these proposed changes to the tax codenearly 4 trillion over 10 years according to estimates by the tax policy center and the tax foundation two nonpartisan think tankswould be used to provide tax relief for lower and middle income taxpayers and pay for spending priorities such as improving.

More From Are Kamala Harriss Parents Alive

- Kamala Harris Info

- Joe Biden 2020

- Vice President Residence Location

- Biden Birthday Meme

- Harris Democrat

Incoming Search Terms:

- National And State By State Estimates Of Joe Biden S Revenue Raising Proposals Itep Harris Democrat,

- Tale Of The Tape Comparing The Tax Plans Of Joe Biden And Bernie Sanders Harris Democrat,

- Politifact Ad Attacking Joe Biden S Tax Plan Takes His Comments Out Of Context Harris Democrat,

- How Biden S Tax Plan Would Affect Five American Households Wsj Harris Democrat,

- Would Joe Biden Significantly Raise Taxes On Middle Class Americans Committee For A Responsible Federal Budget Harris Democrat,

- Biden Tax Plan Details Analysis Election 2020 Tax Foundation Harris Democrat,