Charitable Donations 2020 Cares Act, Braden S Hope For Childhood Cancer On Twitter Did You Know That You Save While Giving In 2020 The Cares Act Outlines Big Savings For Charitable Giving Research Gives Children With Cancer Hope

Charitable donations 2020 cares act Indeed recently is being hunted by users around us, perhaps one of you personally. Individuals now are accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the name of the article I will discuss about Charitable Donations 2020 Cares Act.

- Covid 19 Stimulus Cares Act Includes Incentive For Donors United Way Of North Central Ohio

- Covid 19 Relief New Rules For Deducting Charitable Contributions

- There S Never Been A Better Time To Give The Hope Effect

- Cares Act Increases Deductions For Charitable Contributions Care For Real

- Cares Act 100 Of Agi Limit On Charitable Contributions Explained Internewscast

- The Cares Act Info By College Of Charleston Issuu

Find, Read, And Discover Charitable Donations 2020 Cares Act, Such Us:

- Cares Act Allows For 300 Above The Line Charitable Giving Deduction Peoples City Mission

- Charitable Giving Incentives In Cares Act Cause Inspired Media

- Charitable Giving And Tax Planning In 2020 Community Foundation Of Western Nevada

- Charitable Giving 6 Things To Know About The Above The Line Deduction In The Cares Act Aspyre

- The Cares Act And Charitable Giving Medsend

If you are looking for Vice President Election In Usa you've come to the ideal location. We have 100 graphics about vice president election in usa including pictures, pictures, photos, wallpapers, and more. In such webpage, we additionally provide number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

The Cares Act Makes Charity Beneficial For All Taxpayers In 2020 Portland Rescue Missionportland Rescue Mission Vice President Election In Usa

Grow Your 2020 Charitable Giving Increased Deductions Under The Cares Act Shutts Bowen Llp Vice President Election In Usa

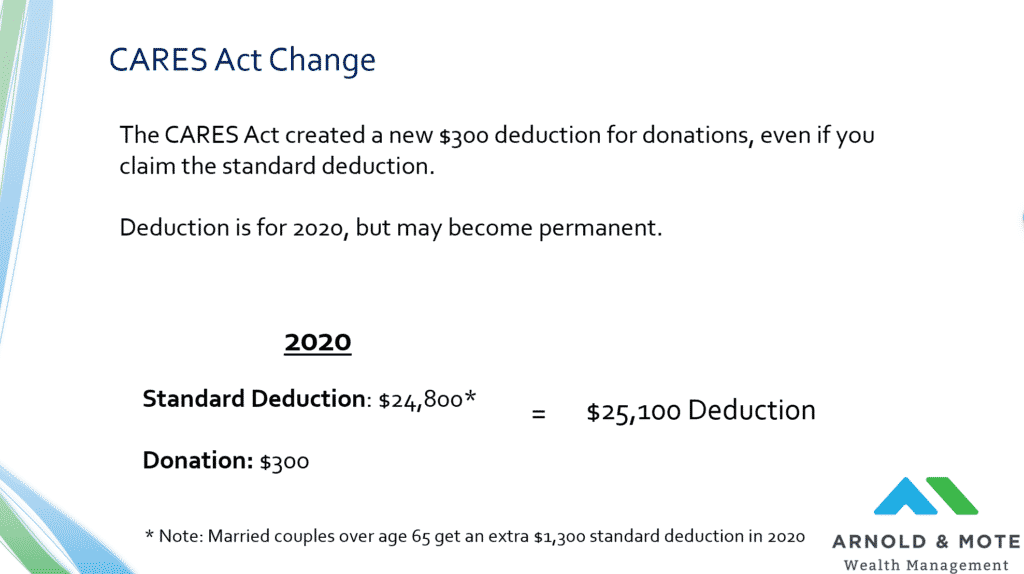

Under the tcja the annual charitable deduction by a corporation is generally limited to 10 of taxable income while a 15 limit applies to charitable contributions of food.

Vice president election in usa. As part of the bill individuals and corporations that itemize can deduct much greater amounts of their contributions. The cares act expands the charitable deduction but it wont do much to increase gifts to non profits. In theory one could reduce 2020s tax liability down to 0 through itemized charitable contributions.

In order to encourage charitable contributions in 2020 for any charitable purpose not just contributions to charities related to the covid 19 crisis the cares act increases the maximum 60 of. The simplest case is that you can take an income tax deduction in 2020 for cash contributions of up to 100 of your agi directly to charity. While the impact of the 22 trillion response bill is far reaching here we focus on the key provisions in the cares act related to charitable contributions.

The cares act also effectively suspended the ceiling for qualified charitable contributions made in 2020 by limiting the deduction to 100 of the taxpayers contribution base cares act 2205 therefore contributions of noncash property are not allowed as an above the line deduction. A donation to a donor advised fund daf does not qualify for this new deduction. The cares act has temporarily done away with this limit.

One should keep in mind that donations to donor advised funds will not qualify as a charitable contribution. New charitable deduction limits. Individuals can elect to deduct donations up to 100 of their 2020 agi up from 60 previously.

And the cares act eliminates the cap entirely for 2020. The coronavirus aid relief and economic security cares act includes temporary tax incentives for individual and corporate donors. The coronavirus aid relief and economic security act cares act was signed into law on march 27 2020.

Cares act 100 of agi limit on charitable. Donations in excess of 25 may be deducted in the following five years.

More From Vice President Election In Usa

- Bt Vp9 Airsoft

- Who Is Douglas Emhoff Ex Wife

- California Donuts Logo

- Jill Biden Chicago Ideas

- Biden Harris Print Poster

Incoming Search Terms:

- The Cares Act And Charitable Giving Delta Institute Biden Harris Print Poster,

- Cares Act And Charitable Giving Biden Harris Print Poster,

- Cares Act Impact On Charitable Giving For 2020 Employee Ownership Expansion Network Biden Harris Print Poster,

- The Cares Act Charitable Giving Incentives Biden Harris Print Poster,

- Soroptimist International Of The Americas Inc Biden Harris Print Poster,

- How The Cares Act Impacts Charitable Giving For 2020 Italian Home For Children Biden Harris Print Poster,