Charitable Donations 2020 Irs, Document Your Donation To Preserve Your Charitable Deduction Clark Nuber Ps

Charitable donations 2020 irs Indeed recently has been hunted by consumers around us, perhaps one of you. People now are accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the name of the article I will talk about about Charitable Donations 2020 Irs.

- An Npq Exclusive The 2020 Map Of The Nonprofit Economy Non Profit News Nonprofit Quarterly

- How Large Are Individual Income Tax Incentives For Charitable Giving Tax Policy Center

- Qualified Charitable Distributions Fidelity

- Taxes For Independent Contractors All You Need To Know Lili Digital Banking

- Here S When Your Tax Return Could Spark Interest From The Irs

- Irs Covidreliefirs On Twitter Individuals And Corporations Can Now Carry Over To The Next Year Charitable Contributions That Exceed The Agi Limitation The Contribution Must Be Cash Made To A Qualifying Organization

Find, Read, And Discover Charitable Donations 2020 Irs, Such Us:

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcrcorhuzo Jpq0ami4qhroezmzo7ybky3uh6x0gf2xptw8uiao4 Usqp Cau

- Court Holds For Irs On Charitable Deductions Grant Thornton

- Donation Value Guide 2019 Excel Spreadsheet Fill Online Printable Fillable Blank Pdffiller

- Charitable Gift Bunching Fiduciary Trust Company

- Arizona Charity Donation Tax Credit Guide Give Local Keep Local

If you re searching for Biden Biden you've reached the right place. We ve got 104 graphics about biden biden adding images, photos, photographs, backgrounds, and more. In these webpage, we also provide variety of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

For taxpayers who have not itemized deductions they received no tax benefit as a result of charitable giving.

Biden biden. One way to help these institutions recover would be to allow all taxpayers to deduct charitable contributions in the year 2020. Donation value guide for 2020how much is your charitable giving worth. Qualified contributions are not subject to this limitation.

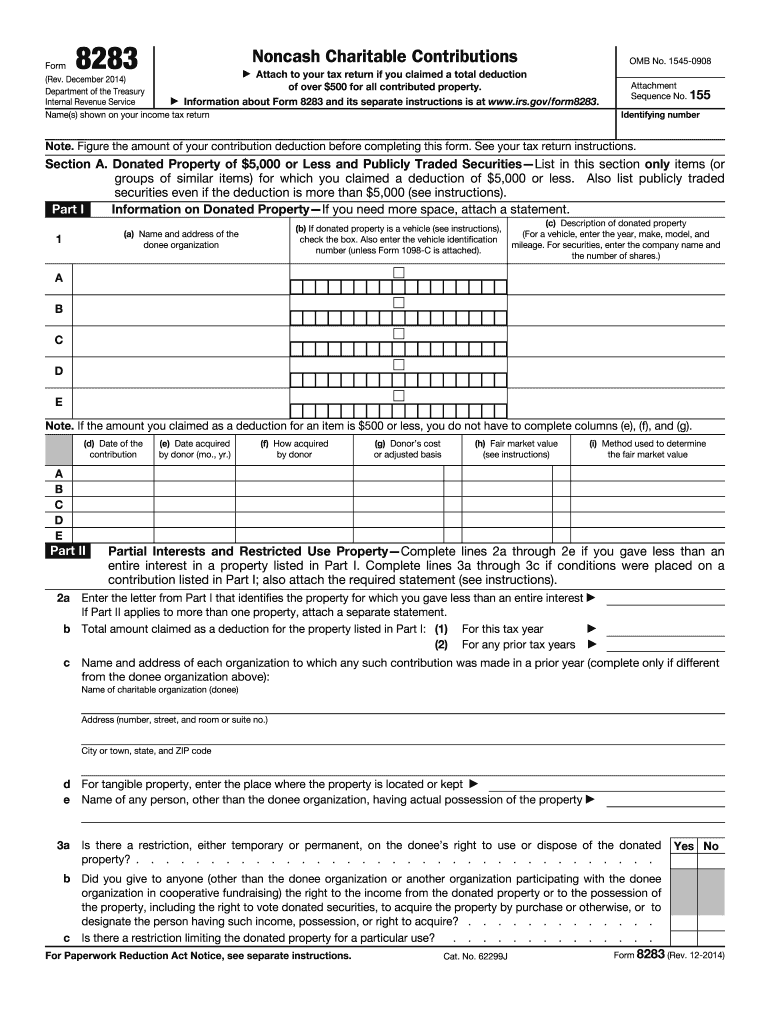

Contributions by sole proprietorships partnerships limited liability companies and s corporations arent claimed by the entities. In prior years the income tax. A charitable contribution deduction for cash donations in 2020 is capped at 25 of taxable income up from the usual 10 of taxable income limit.

Temporary suspension of limits on charitable contributions in most cases the amount of charitable cash contributions taxpayers can deduct on schedule a as an itemized deduction is limited to a percentage usually 60 percent of the taxpayers adjusted gross income agi. For other donors. They pass through to owners who claim them on.

As tax expert bernie kent explains consider a taxpayer who has 1 million of agi for 2020 and would like to make a 3 million charitable contribution this year. How to make sure your charity donation is tax deductible. The law suspended required minimum distributions that would.

8 types of charitable giving. A conundrum for retirees the other big cares act related news for charitable contributions is only indirect. Now taxpayers who do not itemize can take advantage of a new above the line deduction of up to 300 for amounts contributed to charity in 2020.

The 411 on rmds for 2020. Substantiating charitable contributions a brief description of the disclosure and substantiation requirements for contributions to charitable organizations. For example if your client wants to make a large charitable donation in 2020 due to a financial windfall they can do this and potentially reap a higher tax benefit than in a normal year.

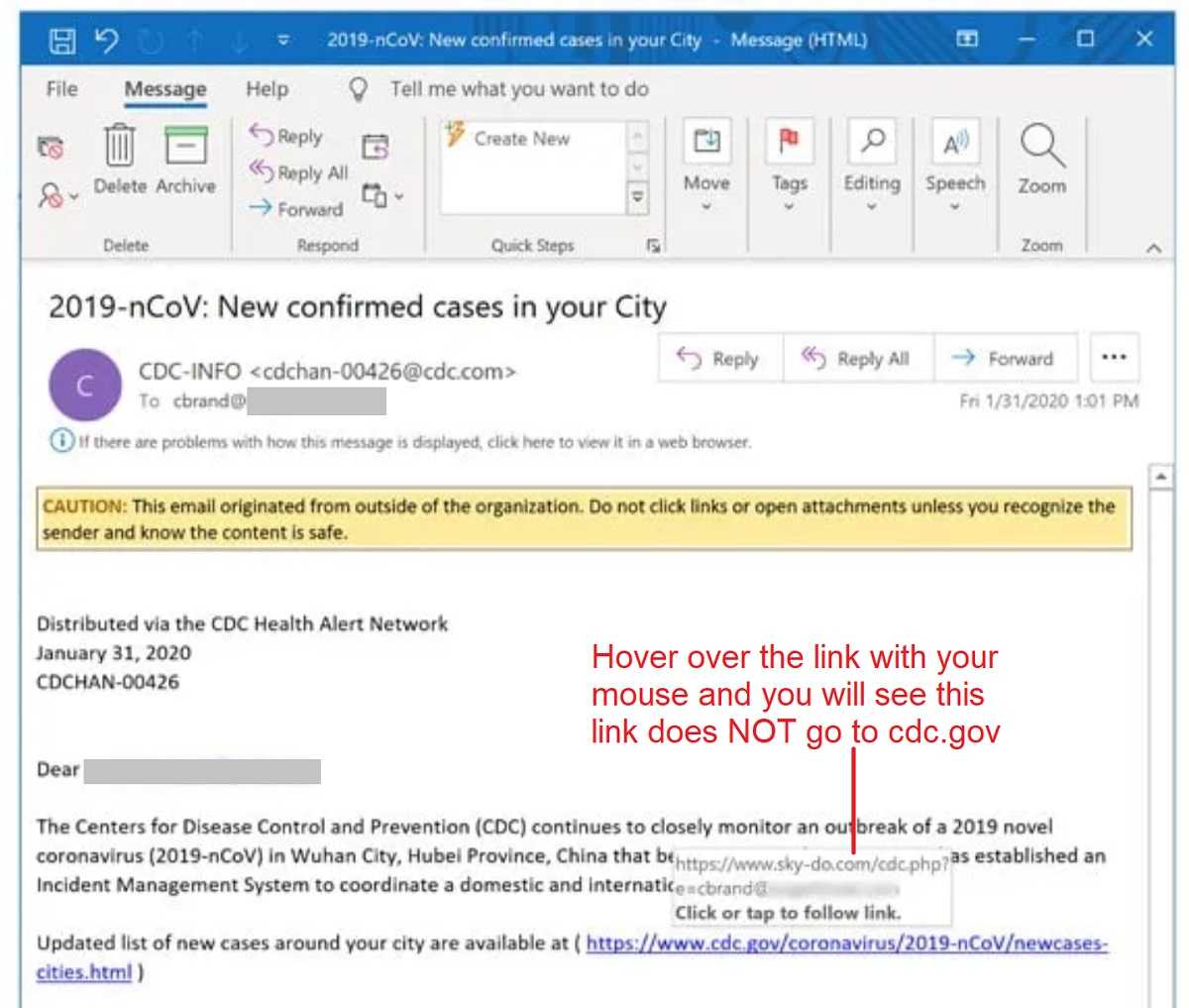

Tax deductions for charitable donations. How donors charities and tax professionals must report non cash charitable contributions. Someone out there can surely use them and the internal revenue service is willing to give you a tax break for your generosity.

Tips for taxpayers making charitable donations tips to ensure that contributions pay off on your.

More From Biden Biden

- She Cant Do That Shoot Her Meme

- Democratic Vice President Nominee

- Who Is Harrison

- Website Launch Campaign Examples

- Kamala Harris Plan

Incoming Search Terms:

- Ensuring Charitable Contributions Are Made To Qualifying Organizations 2008 Taxes To 2020 Taxes Kamala Harris Plan,

- Daily Chart How Generous Are America S Rich Graphic Detail The Economist Kamala Harris Plan,

- Irs Gives Businesses A Break For Donations Related To Salt Cap Accounting Today Kamala Harris Plan,

- Charitable Gift Bunching Fiduciary Trust Company Kamala Harris Plan,

- Court Holds For Irs On Charitable Deductions Grant Thornton Kamala Harris Plan,

- Document Your Donation To Preserve Your Charitable Deduction Clark Nuber Ps Kamala Harris Plan,