Charitable Donations 2020 Standard Deduction, Please Help With Req A For Agi Charitable Contrib Chegg Com

Charitable donations 2020 standard deduction Indeed recently is being sought by consumers around us, perhaps one of you personally. People are now accustomed to using the internet in gadgets to see video and image data for inspiration, and according to the name of the post I will talk about about Charitable Donations 2020 Standard Deduction.

- Developing A Charitable Giving Strategy To Maximize Your Giving

- 2

- Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcri5cv03dxns5gn9sjtgkdmahggjre9gaccta Usqp Cau

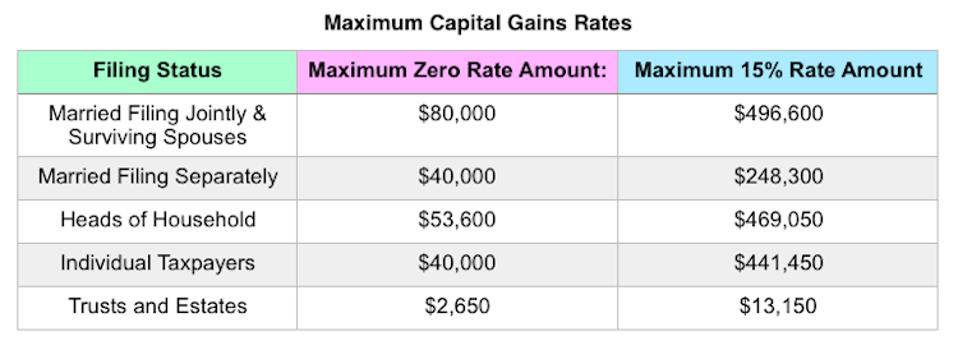

- Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

- Income Tax 101 Your Tax Return In Plain English

- Ll Dsbdlfrjjnm

Find, Read, And Discover Charitable Donations 2020 Standard Deduction, Such Us:

- Solved Problem 3 43 Lo 9 Each Year Tom And Cindy Bate Chegg Com

- Key Changes For Charitable Giving In 2020 Putnam Wealth Management

- Search Q Standard Deduction 2018 Tbm Isch

- Wsj Tax Guide 2019 Charitable Donation Deduction Wsj

- Sound Stewardship The Biggest Gift Of The New Tax Law Sound Stewardship

If you are looking for Joe Bidens Family you've come to the perfect place. We ve got 104 images about joe bidens family including images, photos, photographs, backgrounds, and more. In such web page, we also have number of graphics out there. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

The deduction cap.

Joe bidens family. This means that people who take the standard deduction which is 12400 for singles and 24800 for married filing jointly in 2020 can still write off up to 300 in donations. The tax cuts and jobs act tcja which went into effect in 2018 roughly doubled the standard deduction. Until the 2017 tax cuts and jobs act tcja individuals could immediately.

In this case if the family eschewed donations for two years but made 30000 in contributions the third year they could take the standard deduction in the first two years and then deduct 50000. Taxpayers should itemize only if all their personal deductions including charitable contributions exceed the standard deduction. They pass through to owners who claim them on.

For taxpayers who have not itemized deductions they received no tax benefit as a result of charitable giving. The coronavirus aid relief and economic security act or cares act created several incentives for people to help charities right away including a charitable deduction of up to 300 in 2020. Cash contributions to public charity.

The second change lifts the cap on how much a donor can deduct in charitable gifts in a single year. Now taxpayers who do not itemize can take advantage of a new above the line deduction of up to 300 for amounts contributed to charity in 2020. For 2020 the standard deduction is 12400 for single taxpayers and 24800 for marrieds filing jointly.

If youve been claiming the standard deduction recently you may have gotten a bit lax about saving receipts for charitable contributions. Contributions by sole proprietorships partnerships limited liability companies and s corporations arent claimed by the entities. But for 2020 you have an incentive to hang on to proof.

Charitable contributions can only reduce your tax bill if you choose to itemize your taxes. For wealthy clients who might be in a position to make a donation in excess of 100 of their agi their 2020 charitable deduction will be limited to a maximum of 100 of their agi.

More From Joe Bidens Family

- Harris Debate

- President Duterte Speech Today

- Who Is Cheating Her Husband Riddle

- Kamala Harris Father

- Kamala Harris Can She Be President

Incoming Search Terms:

- How To Take Advantage Of Donor Advised Funds And Special 2020 Tax Deductions For Donations Kamala Harris Can She Be President,

- Charitable Gifting Strategies For The End Of The Year Taylor Hoffman Kamala Harris Can She Be President,

- Https Crsreports Congress Gov Product Pdf In In11420 Kamala Harris Can She Be President,

- What Is A Tax Deduction Daveramsey Com Kamala Harris Can She Be President,

- Charitable Contributions And The New Tax Law Doing The Right Thing Ellin Tucker Kamala Harris Can She Be President,

- Https Stjamesonline Org Documents 2020 9 Cares Pdf Kamala Harris Can She Be President,

/cdn.vox-cdn.com/uploads/chorus_asset/file/19650805/AdobeStock_314166542.jpeg)

.PNG)

/ScheduleA-ItemizedDeductions-fc8aa38a36d84f93a4fc2cbb62779cd0.png)