Harris Property Taxes, Harris Scholar Fights To Reform Property Tax System

Harris property taxes Indeed recently has been sought by consumers around us, maybe one of you personally. People now are accustomed to using the net in gadgets to see video and image information for inspiration, and according to the name of this article I will discuss about Harris Property Taxes.

- Two Harris County Commissioners Block Proposed 8 Percent Property Tax Hike Texas Thecentersquare Com

- Property Taxes In Texas Harris County Commissioners Eyeing Property Tax Rates Abc13 Houston

- How Do I Protest My Property Taxes In Harris County Property Consulting Group

- Harris Scholar Fights To Reform Property Tax System

- How To Reduce Property Tax In Harris County Appraisal District By Cutmytaxes Issuu

- How To Protest Your Property Taxes Harris County Youtube

Find, Read, And Discover Harris Property Taxes, Such Us:

- Facet Maps Harris County Appraisal District

- What Does The Harris County Appraisal District Have To Do With My Commercial Property Taxes Property Consulting Group

- Who Has Lower Real Estate Taxes Montgomery County Or Harris County Discover Spring Texas

- Property Exemptions And Protests Presentation At Parker Williams Branch Harris County Public Libraries Mdash Nextdoor Nextdoor

- How The Harris County Tax Deferral Works Senior Citizen Property Taxes

If you re looking for Oct 25 2020 you've come to the ideal location. We have 104 images about oct 25 2020 including pictures, photos, pictures, backgrounds, and much more. In these web page, we additionally provide variety of images available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

Harris county appraisal district 13013 northwest freeway houston texas 77040 6305 office hours hours.

Oct 25 2020. The phone number for making property tax payments is 713 274 2273. Harris property information hosting contact harris. One of the primary responsibilities of the office of ann harris bennett harris county tax assessor collector voter registrar is to levy collect and disburse property taxes.

Harris county hospital district. Still she supports the idea of reparations to an extent. The federal government is generally barred from levying property taxes under the constitution.

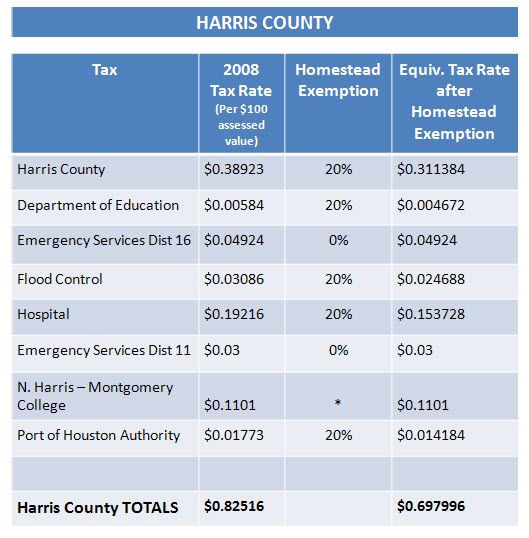

Houston community college system. Harris county property tax bills can be paid by touch tone phone at any time from any place in the world seven days a week. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

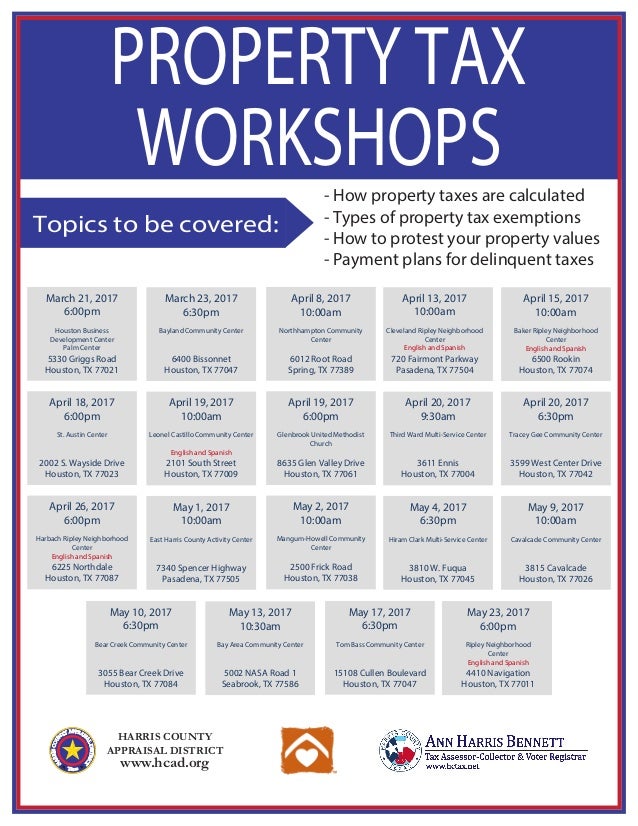

Property tax workshops holiday schedules and closings application deadlines and more. Property taxes also are known as ad valorem taxes because the taxes are levied on the value of the property. Port of houston authority.

Yearly median tax in harris county the median property tax in harris county texas is 3040 per year for a home worth the median value of 131700. Property taxpayers may use any combination of credit cards andor e checks for payment. No capitation or other direct tax shall be laid unless in.

Harris county collects on average 231 of a propertys assessed fair market value as property tax. Article 1 clause 9 section 4 states. Harris county appraisal district 13013 northwest freeway houston texas 77040 6305.

Theres no evidence harris ever suggested introducing a federal tax on homes to pay for reparations. Property tax related forms and instructions for downloading and completing the latest versions of those forms.

More From Oct 25 2020

- What Is Joe Biden Running For

- Kamala Harris Background Information

- Whos The Senator Of California 2020

- Kamala Harris Presidential Announcement Oakland

- Harris Newsom

Incoming Search Terms:

- Harris County Tax Office Harris Newsom,

- How Do I Protest My Property Taxes In Harris County Property Consulting Group Harris Newsom,

- Who Has Lower Real Estate Taxes Montgomery County Or Harris County Discover Spring Texas Harris Newsom,

- Top 10 Delinquent Property Taxpayers In Harris County Harris Newsom,

- Joe Biden And Kamala Harris Reveal Real Estate Taxes Harris Newsom,

- What Does The Harris County Appraisal District Have To Do With My Commercial Property Taxes Property Consulting Group Harris Newsom,